How long can Pingduoduo's growth mythology last and compete with Juhuasuan?

In addition to the core e-commerce revenue, how to find another growth engine determines how high Pingduoduo's growth ceiling can be. NetEase koala has invested in Ali's arms, and Pingduoduo's market value has hit a record high. As of the close of US stocks on September 5, Pingduoduo's stock price rose 2.6%, the market value reached 40.5 billion US dollars, the first breakthrough of 40 billion US dollars mark, continue to stabilize the position of China's fifth largest Internet company (market value behind Apple, Tencent, US group reviews) , Jingdong).

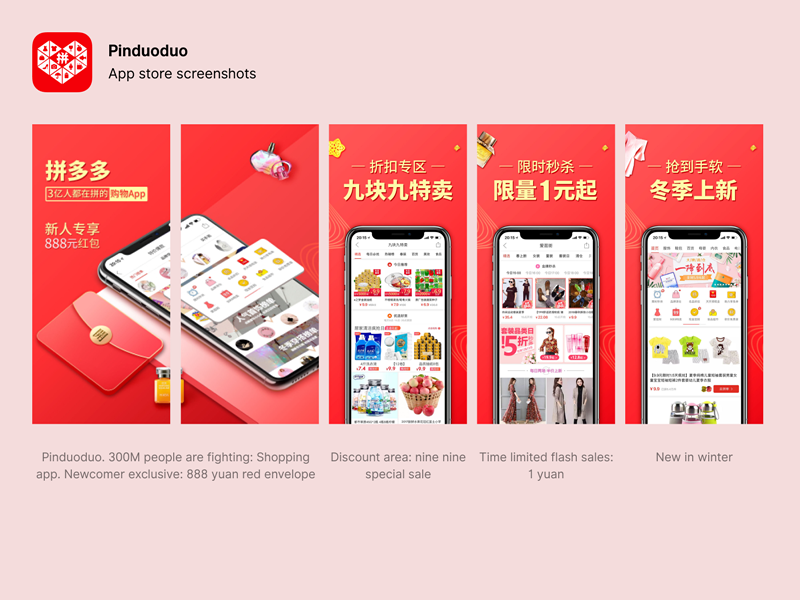

Since its establishment in September 2015, in just four years, relying on the huge consumption potential of the sinking market, Pingduoduo has created one growth myth. One year and now, Pingduoduo's share price has increased by 55.39%. At a time when major Internet giants are in a growth dilemma, Pingduoduo’s growth remains solid.Beyond the five rings, Pingduoduo after the listing is trying to reverse its brand tonality, but the sinking market battle has become more and more intense since last year. Faced with the double attack between Ali and JD, Pingduoduo's market has become less stable. In addition to the core e-commerce revenue, how to find another growth engine determines how high Pingduoduo's growth ceiling can be.

How is the market value of 40 billion US dollars created?

In the past few years, when everyone said that the demographic dividend was net and the flow became expensive, Pingduoduo created an exponential growth.It took only 2 years to break 100 billion GMV (Jingdong used 10 years, Taobao used 5 years, and the US group that just listed used it for 6 years); it was listed in three years, and the IPO market value was 28.8 billion US dollars. It is the Jingdong and the US Mission. More than half; currently GMV (total turnover) 709.1 billion yuan (as of 2019.06.30), is 60% of Jingdong. On August 29, US stocks closed. The four-year-old Pingduoduo stock price rose 8.66% to $33.61 per share, with a market capitalization of $39.1 billion, surpassing Baidu (market value of $36.5 billion) and becoming China's fifth-largest Internet listed company. Yesterday, Pingduoduo once again refreshed its market value record, breaking through the $40 billion mark for the first time. This is only 14 months before the market value of its listing exceeded $30 billion.

In 2018, a new generation of Internet companies represented by Meituan, Xiaomi and Pingduoduo were listed. However, the stock price movements of the three are not the same. Xiaomi and the US group both fell below the issue price, but Pingduoduo alone stood out. Since the IPO, its share price has risen more than 60%, becoming the best performing Internet company in China in 2018. Good financial performance is the key to the continued rise of Pingduoduo’s share price. In the previously released Q2 earnings report, Pingduoduo achieved revenue of 7.29 billion yuan, an increase of 169%. Among them, the number of monthly livelihoods increased by 76.3 million in a single quarter, a record high, and many figures exceeded analysts' expectations. As the third pole of e-commerce, Pingduoduo's speed is really enviable. Relying on the fission of social fission, in just a few years, a hole was squeezed out of the crack and it was never made. It takes a full 17 years to know that Jingdong has completed this market value. After experiencing the Liu Qiangdong incident, Jingdong’s share price was once swayed, and in early 2019 it barely returned to the $40 billion mark. Behind the growth, Pingduoduo was questioned all the way, but for now, it is no longer the original Pingduoduo.

In terms of the number of active users, as of June 30, 2019, the number of active buyers of Pingduoduo's annualization was 438 million, which exceeded the 321 million of Jingdong. Aurora Big Data reports that nearly half of Pingduoduo’s new users in 2019 came from first- and second-tier cities.The improvement of user quality has become the core driving force of Pingduoduo GMV. In 2018, Pingduoduo users per capita consumption contributed 1126.9 yuan, up 95% from 2017's 576.9 yuan, higher than the annual active user 71% increase, for the first time became the main driving force to promote GMV. Although it is still behind Jingdong and Ali in the customer price unit, but now Pingduoduo is more concerned about the frequency of users' purchases. This can be seen from the commodity system, still based on the general consumer goods. In the previous interview with the media, Pingduoduo co-founder Dada said that Pingduoduo now cares more about the price of the customer, compared to the user's stickiness is more important.

In 2018, the frequency of Pingduoduo users’ purchases rose from 17.6 last year to 26.5, an increase of 51%. The increase in the frequency of user purchases, that is, the increase in stickiness, is the reason why Pingduoduo maintains high growth. Previously, many people thought that when users spend 1 or 2 times on Pingduoduo, they will leave the platform because of product quality. Nowadays, the frequency of purchases by users exceeds 26 times/year, and the per capita annual consumption has increased from more than 300 to the current level of 1,000 yuan. I believe that such criticisms lack data and will disappear.

Where is the growth ceiling?

What is supporting the performance of Pingduoduo Q2's eye-catching earnings? Online marketing service revenue. In the past Q2, Pingduoduo’s online marketing service revenue reached 6.467 billion yuan, a year-on-year increase of 173%. Compared with this, the commission income is 823 million, and the growth rate of the chain has declined.

Since the complete abandonment of self-employment since 2017, Pingduoduo has learned the old path of Taobao. Through low commissions and commission subsidies to attract merchants to settle in (disclosed in the prospectus, Pingduoduo commission income standard is 0.6% of the volume), quickly set up trading pools and business categories, expand the scale of transactions. However, with the gradual saturation of the number of merchants, Pingduoduo commission income will inevitably face the risk of slowing down. How to continue to maintain high growth, marketing service revenue has become Pingduoduo's lifeline. After changing to the Taobao model, Pingduoduo’s revenue once rose. In a year, Pingduoduo’s revenue has risen 36 times, mostly by marketing revenue. From Q1 in 2018 to the present, Pingduoduo’s online marketing services accounted for more than 80% of revenue.

But in order to completely move toward the Taobao model, that is, relying on marketing revenue as the core business model, Pingduoduo still has a long way to go. Ali's choice was to split Taobao Mall from Taobao and rename it “Tmall” to attract more merchants by positioning differences. This not only brings a premium space to the platform, but also enhances the brand tonality and earns a lot of advertising fees. After all, compared to many small and medium-sized businesses, the marketing expenses of big brands are even greater. Today's marketing service revenue has become the core growth engine for Tmall and even Ali. But it is not easy for Pingduoduo to do this. The natural "two-choice" mechanism of the e-commerce industry has blocked Pingduoduo's "upgrade" road to some extent. Because of Ali's huge volume, the head brand that has already settled in Taobao and Tmall is difficult to go to Pingduoduo to open a store in a short time, and Jingdong's strong 3C home appliance category also firmly occupies the user's mind, which makes Pingduoduo earn the head. The desire for business advertising fees has been greatly reduced.

On the eve of 618 this year, Galanz as the brand's public responsibility for Tmall "two choices one", fell to the Pingduoduo camp. This is seen as a model of Pingduoduo's efforts to high-end brands. Interestingly, when interviewed by the media, Huang Wei once said, "Pingduoduo will not do the Tmall mode. If you don't do it now, you won't do it in the future." This means that Pingduoduo simply relies on attracting big brands to complete the transformation of consumption and transformation. Not smooth. In addition to Ali, JD.com is also fighting for online advertising. In the first half of the year, Jingdong completed a major revision of the mobile app, promoting information streaming and thousands of people, with the aim of improving the accuracy of user services. From the marketing point of view, such a revision can also greatly improve the efficiency of Jingdong marketing advertising, thereby attracting more brand owners to save money. Xu Lei, CEO of Jingdong Mall, said in the Q2 financial report that the revision of APP has made it possible for the growth of Jingdong advertising to become realized. Such potential energy will gradually manifest in the next few quarters.

Faced with a tough situation, Pingduoduo's choice is brand subsidy and support, and the curve improves the tonality of the platform. In December last year, Pingduoduo launched the “New Brand Program”, which plans to support 1,000 brand-name factories. But to complete such a plan is also very difficult, after all, Ali and Jingdong have long been eyeing this cake. Unlike Ali and JD.com, in addition to the source of revenue for core e-commerce, Pingduoduo's other sources of revenue are extremely limited. How to keep the market, especially how to get more advertising fees from brand owners, has become the key to whether Pingduoduo can maintain high growth in the future. On the road to hit the market value of 50 billion, Pingduoduo needs more stories.

The shopping festival is not afraid of many, and I am afraid that there is no party. GMV 58.5 billion, just past the 99 cost-effective section, in the first year after the upgrade, handed over a good answer. On September 9th, the sales of Taobao increased by 40% year-on-year, which was 2% higher than the 38% of Tmall 618. The upgrade of the cost-effective section is just a microcosm of Ali's competition for the sinking market. In the past year or so, in the face of a lot of hard work, Ali's sinking action has not stopped at the product level. In reverse order of time, in March of this year, Taobao App launched a special sale area; Juhuasuan, daily sales, rush to buy and merge; in September 2018, Taobao comprehensive revision, strengthen the feed recommendation of the feed; August, Taobao launched a "small group" on the Alipay homepage Section. In this wave of intensive product and team adjustments, Juhuasuan is always the protagonist of the story. If you say that in the past few years, in order to be a big cat, Juhuasuan chose "sacrifice", and now it is time to return to the rivers and lakes.

Juhuasuan goes out again

In 2015, when the cat was busy with the consumption upgrade, when Taobao focused on building the community, Juhuasuan, which had no chance in the thousands of battles, stayed on the old road with cheap discounts, and its strategic position dropped. In December 2016, Juhuasuan merged into Tmall and turned into a large-scale marketing platform to help Tmall and the brand.In 2016, when Juhuasuan merged into Tmall, it was just three months since it was launched. At that time, Ali and Jingdong, who were fighting in the war, did not notice that this startup company with the main model of the group would rise rapidly through the “9 9 packs” and go straight to the traffic virgin land in the sinking market.

The sudden rise of a lot of people made Ali unable to guard, and made Ali realize that the scale of the larger users is still sinking. At this time, Juhuasuan, which was originally focused on cost-effectiveness, was once again remembered by Ali.“Re-incubating a platform, a brand, not thinking about it internally, but it’s not easy to start over. Juhuasuan is always doing limited-time special sales and focusing on cost-effectiveness. Why don’t we take it back?” When Juhuasuan is fighting against the fight, Alibaba, the general manager of the Juhuasuan business unit, said.

According to Caroluo, the business form of Juhuasuan's limited time sale is different from the "sales" sales method of Tmall, which can focus on explosive sales, more suitable for short-term, high-frequency marketing, and easier to promote the growth of merchants' transactions. Get new customers for the brand. Tmall’s data also shows that merchants who have done well in the last two years have used Juhuasuan’s outbreak effect almost without exception.In this context, in March of this year, Juhuasuan and the other two major sales-oriented businesses that originally belonged to Taobao BG, “Amoy Shopping” and “Daily Sale” were formally merged to form the current big Juhuasuan division. Although it has not been rumored to be independent of Taobao and Tmall, Juhuasuan is currently relatively independent internally.

The product line has been built, and the team's integration is accompanied.

Before the integration, the price-performance market business of the Amoy series was scattered among the three business lines of Juhuasuan, Tiantian special sale and Amoy shopping. Among them, Juhuasuan belongs to Tmall BG, and the daily sale and the Amoy purchase belong to Taobao BG, although each has its own focus, but Different responsible persons report, independent assessment of KPI, inevitably overlap in the business and commodity side.

Take the daily sales as an example. Previously, it mainly helped the industrial belt factory to upgrade and upgrade through digital technology, which coincided with Juhuasuan itself helping brand merchants to acquire customers' attributes. In order to avoid internal inefficient competition, after the integration, Juhuasuan has clearly planned these two parts of the business, forming two core businesses of “new brand supply” and “new factory supply”.“New Brand Supply” helps brand merchants to develop the sinking market. Yun Cong, the general manager of the brand business of the Big Juhuasuan Division, is responsible for the “new supply of the factory”, and the former Tian Tian special sales manager Tang Song is responsible for the big Juhuasuan business. The general manager of the industrial belt operation, focusing on the industrial belt, both return to Jialuo. The result of the integration is that the KPI assessment is re-divided and no longer competes for merchants and commodities.

In this cost-effective festival, the industrial belt merchants under the responsibility of Tang and Song won a lot of resources support within Juhuasuan and became a highlight of the 99 cost-effective festival. On September 9-10, two days, Juhuasuan’s full-platform industry took more than 40 million orders, a year-on-year increase of over 438%."From November 2018, the decision was made to internal organization adjustment in December, and the 1st position of each business was set up. In January 2019, based on the new organizational structure and strategy, the merger was announced in March of the same year, and the details of the team were carried out. "Adjustment", for the integration of the team, Jialuo revealed that "the efficiency is very high, and the whole process took less than half a year."

It is reported that in order to elaborate on why Ali has to make this change, why should he face sinking users and a new commercial war, Xiaoyao even personally met with the team. At the same time, Jialuo and Taobao & Tmall President Jiang Fan also arranged a special meeting to interact with employees and answer employee questions to dispel their concerns. In order to stimulate the consumer demand in the sinking market more, Juhuasuan also deliberately launched the "88 red envelope saving card" before the holiday. With the “88VIP”, another major membership system under the Ali E-commerce ecosystem, users who need more than 1000 mischievous values can purchase at a price of 88 yuan. The entry threshold for 88 red-bag money-saving cards is lower, and consumers have a minimum monthly fee of 6.8 yuan. Prices can be opened and shopping offers are available all year round.

"88VIP is mainly to open up the Ali economy, so that consumers can have an affordable experience across the scene; 88 money card is focused on the Amoy platform, the core is to provide the most cost-effective minimum threshold for the user." Said. At present, 88vip can only cover the products of Tmall Mall, and Juhuasuan's money-saving card can cover all the products of Taobao. But the two do not conflict and can be used in combination. However, the festival is only temporary. Juhuasuan is still focusing on the supply side upgrade. How can we truly provide high quality goods through cooperation between brands and industry belts? This idea coincides with the “new brand plan”. After being smothered by Ali and JD on the "two choices", the company launched a "new brand plan" in December last year, and plans to support 1,000 factories to complete the brand upgrade.

After the sinking market was eye-catching by Juhuasuan and JD.com, the “upstream” plan that has been put together has also accelerated. Previously, some media broke the news that many of them were considering upgrading the "time-limited spike" channel to the "second fight" business group. It is reported that the business group will enter the first and second tier cities to meet the challenges of Juhuasuan. During the 618 period this year, the person in charge of the "limited time spike" has introduced that the "limited time spike" has become the platform's traffic engine, and the overall data is almost equal to Juhuasuan. During the 618 period, the “limited time spike” order increased by 320% year-on-year, which exceeded the overall growth rate of the GMV in the same period, and became the most important reserved repurchase traffic pool.

An interesting news is that in the days of the cost-effective festival, many investors have been nervously staring at the high-selling stock prices, which are afraid of being involved. Apparently, Ali’s determination to sink the market has already made the company and its shareholders nervous. On October 10th, the fight will be ushered in its own anniversary, and the competition on the sinking market will continue.

所有评论仅代表网友意见